Business Valuation Methods

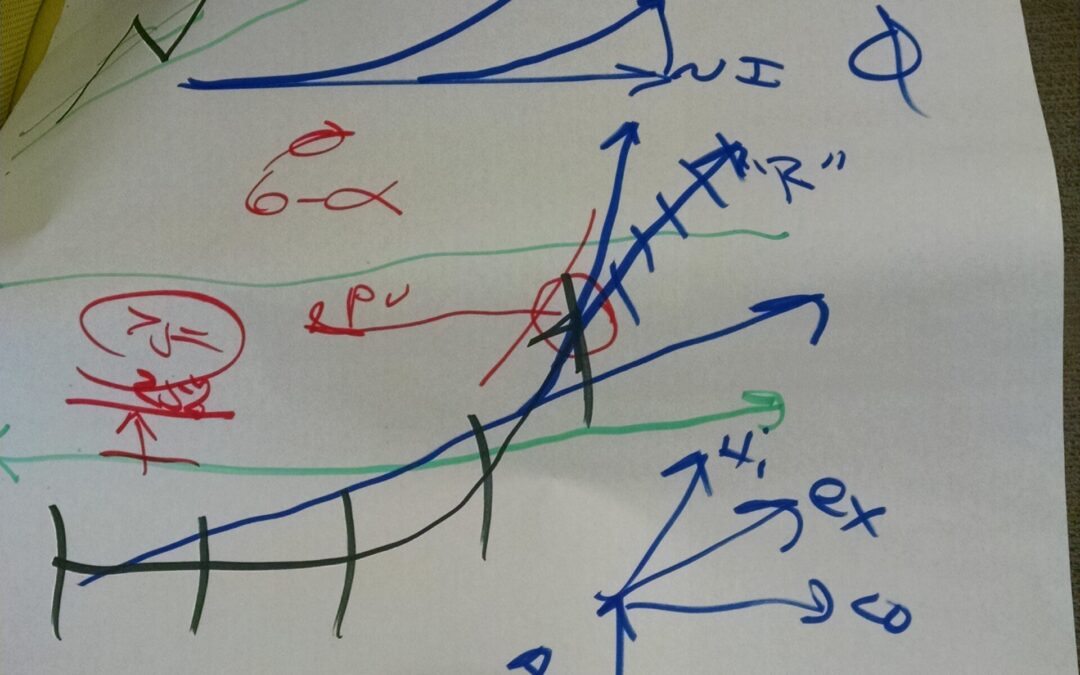

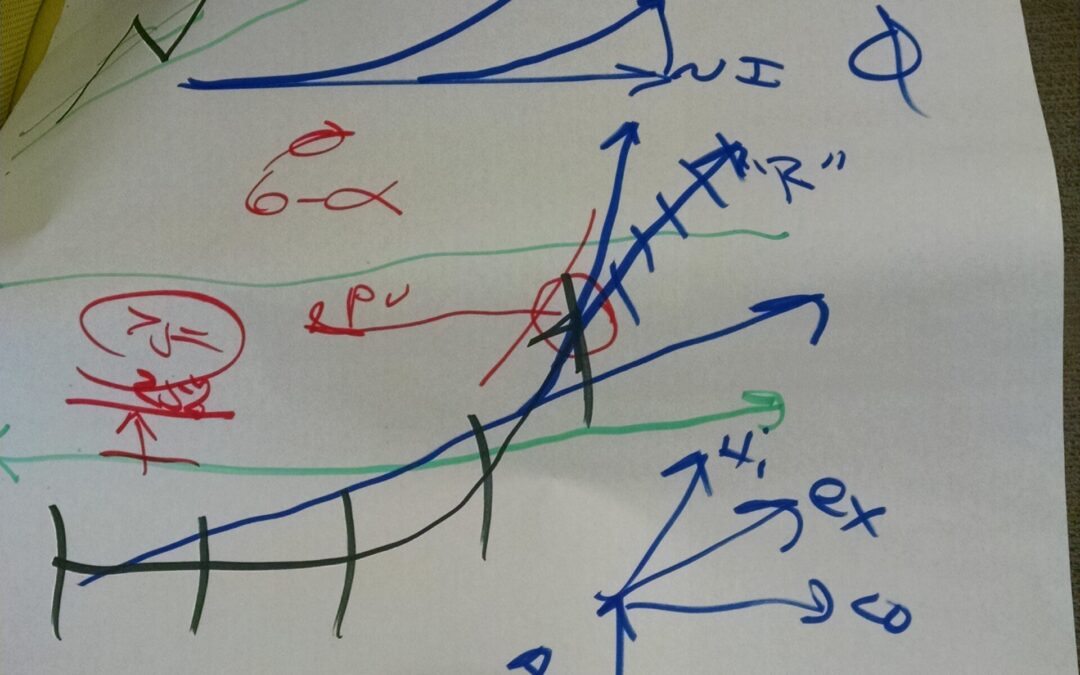

Calculating the Cost of Capital. The cost of capital is one of the single most important elements of consideration in a business valuation. Errors in the cost of capital can cause significant errors in the value of a business.

Business Valuation Methods

Competitive Advantage. One of the most important small business valuation ideas is to build a company that provides a service not provided by anyone else. If your company can separate itself from others in the marketplace, this is an instant way to increase your value to potential suitors.

Business Valuation Methods

Need help understanding all the different Business Valuation Methods? There are three primary business valuation methods, the Net Asset Method, Market Method, and Income Method. I’ll discuss each in this article. While it is true that there are several different business valuation methods, they do not have to be confusing.

Business Valuation Methods

You may need to show your current cost of capital if you are trying to elicit investments for your company. This is to say that your lenders will want to know your financial standing in order to estimate if the cost to them is even remotely worth the risk.

There are several specific business models that can be used, but for business valuations, the cost of capital is the RISK associated with any investments or valuation related to the business. The HIGHER the cost of capital the larger the risk and the lower will be the present value of the business.

Business Valuation Methods

When using rules of thumb to figure the cost of capital, you have to know that there are certain flaws and errors in rules of thumb that can cost an owner or valuation user large losses and errors. Rules of Thumb formulas are estimations and do not take into account the specific company situations or the specific market conditions. Every investment or cost of capital need must consider all of the risk elements. These include 1) the Risk-Free rate, 2) Equity vs. Debt rate, 3) Size rate, 4) Industry rate, and 5) Specific Company rate. Economic conditions may also need to be considered. If you only work with Rules of Thumb then all of the specific conditions will not be considered and large errors can occur.

Business Valuation Methods

Which type of valuation services do you need? This is an important question and will affect the results and your final choice of provider. Calculation analysis looks at limited information and is often for people who are thinking of selling but have not made a final decision. Limited valuation analysis is common when the owner wants to save money and time for a fairly informed valuation. Full valuation services involve very detailed information as well as a visit from the valuator to provide the most accurate estimate of the value.

Business Valuation Methods

When business valuation professionals use the net asset method to value a business they are looking at assets and liabilities to determine the value of a business. The asset method takes the actual assets minus the liabilities of a business and uses them to determine a fair value for a business. The trouble with this method is that assets do not always equal value. For instance, if your company possesses significant intellectual property, these properties may not be completely included in the balance sheet assets. Another reason is the accelerated depreciation methods may be used on the asset value which lowers the real market value of the asset. These examples are why business owners should have issues with business valuation methods that focus only on net assets and nothing else when determining the market value for a company.

Business Valuation Methods

Valuation Metrics and Performance Dashboard Elements | Elements to Increase Company Value Financially | 12-month rolling metric tracking system. It is recommended that a business valuation be done every two years. With the author’s nine methods and calculations, it can be used as a metric for management performance.

Business Valuation Methods

The assumptions from using my methods can reveal how the company may achieve a higher level of performance and value. In a negotiation, an owner can push a higher value by emphasizing the reasons and circumstances that would create that higher value. One value number probably does not tell you the real potential or value of the business. Two to five numbers give you a good range of values and provide solid data sets, to see where the value of your company may be.

Business Valuation Methods

he first step to determine the value of stock options is to determine the value of the company and the overall stock (equity element) value. Only then can a valuator apply the options valuation models to determine the actual stock options package value. Keep in mind that the overall stock value is not the same as a stock option value. This makes it possible for employees to clearly know the value of their benefits package and enables the employer to adjust packages to compensate employees at different levels. When using stock options as compensation for goods and services the stock options valuation ensures that the value is commensurate with the goods or services received.

Business Valuation Methods

The discount for lack of marketability (DLOM) can mean a significant reduction in the value of your stock based on its ability to be marketed adequately. The discount for lack of marketability (DLOM) can mean a significant reduction in the value of your stock based on its ability to be marketed adequately. This is one of three discounts that needs to be taken into consideration for an overall stock, equity and business valuations. There are several key points that a certified valuation expert will consider when trying to estimate the discount for lack of marketability.

Business Valuation Methods

To assess the level of that risk, a four-stage scale has been developed.

The cost of capital is one of the single most important elements of consideration in a business valuation. Errors in the cost of capital can cause significant errors in the value of a business. If your company is valued at $5-15 million and an error of 10% in the cost of capital occurs the value can be off by over $1 million to $5 million or 20% to 33%. It is always best to have a certified valuator assist you in your valuation and the important cost of capital calculation.

Business Valuation Methods

In finance, valuation analysis is required for many reasons including tax assessment, wills and estates, divorce settlements, business analysis, and basic bookkeeping and accounting, which can be managed with software like GeekBooks. Since the value of all things will fluctuate over time, valuations are as of a specific date. Valuations do not last forever; you will need to get them whenever a big event comes up. Remember value always changes.There are many reasons why someone would need a valuation done. Maybe you are selling your business. When you sell a valuation will need to take place to determine how much your company is actually worth.

Business Valuation Methods

If three people owned a portion of the company dispersed as 50%. 49%, and 1%, only one person has controlling interest whereas two people would have a tied controlling interest if they voted together on an issue. Hence the person who own 1% and the person owning 49% would not actually have 1% or 49% of the value of the company separately because his or her stock has no controlling interest. Their stock would be less marketable than the 50% owner because they have no controlling interest. The person with 50% still has controlling interest because the company is now divided in three and that person would control. Any block of equity being valued that has over 50% ownership would not have a minority discount applied in a business valuation.

Business Valuation Methods

The assumptions can reveal how a company may achieve a higher level of performance and value. There is a lot of science and some art in valuation. The net cash flow (benefit stream) present value calculation is all science. The discount factor has science and assumptions. There is variability in the valuation calculations because of risk and assumptions. Without systems, your value decreases. Service and professional businesses can increase their value with systems. Build Systems Early On.

Business Valuation Methods

In finance, valuation analysis is required for many reasons including tax assessment, wills and estates, divorce settlements, business analysis, and basic bookkeeping and accounting. Since the value of all things will fluctuate over time, valuations areas of a specific date. Valuations do not last forever; you will need to get them whenever a big event comes up. Remember value always changes. There are many reasons why someone would need a valuation done. Maybe you are selling your business. When you sell a valuation will need to take place to determine how much your company is actually worth.

Business Valuation Methods

Historical numbers do not necessarily reflect the future. At Excel Management Systems, I like to analyze and calculate two to six Income Method valuation calculations. Many times a historical number does not reflect the direction of the business performance for the future. Many times a historical number does not reflect the direction of the business performance for the future. With just one number, the user only has a myopic view of what the company value may be.

Business Valuation Methods

The assumptions from using my methods can reveal how the company may achieve a higher level of performance and value. In a negotiation, an owner can push a higher value by emphasizing the reasons and circumstances that would create that higher value. One value number probably does not tell you the real potential or value of the business. Two to five numbers give you a good range of values and provide solid data sets, to see where the value of your company may be.

It is recommended that a business valuation be done every two years. With my nine methods and calculations, it can be used as a metric for management performance.

Business Valuation Methods

A business valuation typically uses five years of financial data but the business may operate for another 20 years. What credit do you get for the 6-20 years out in the five-year business model? NONE!

Errors occur when a five-year discount cash flow is analyzed without consideration, for an ongoing business. To consider the future operation, a terminal value is calculated. If you use Before Tax Financial data with an After Tax Discount Factor, it will create a large value-over-statement error.

With the same example above data points of $500k to $1.4M benefit stream, if you mix before tax financials with after-tax discount factor it could create an overstatement of value, of $1.8 Million.

Business Valuation Methods

The actual definition of preferred stock is equity that has priority over common stock with respect to dividend payments and asset distribution during liquidation. The hybrid personality of preferred stock is what can make it difficult to accurately value this type of investment. While the idea of offering public and private stocks is a good one, it is important that you know exactly how each type of stock works and what you can do to ensure that you always know the value of your company for all forms of equity stock or units.