Financial Principles

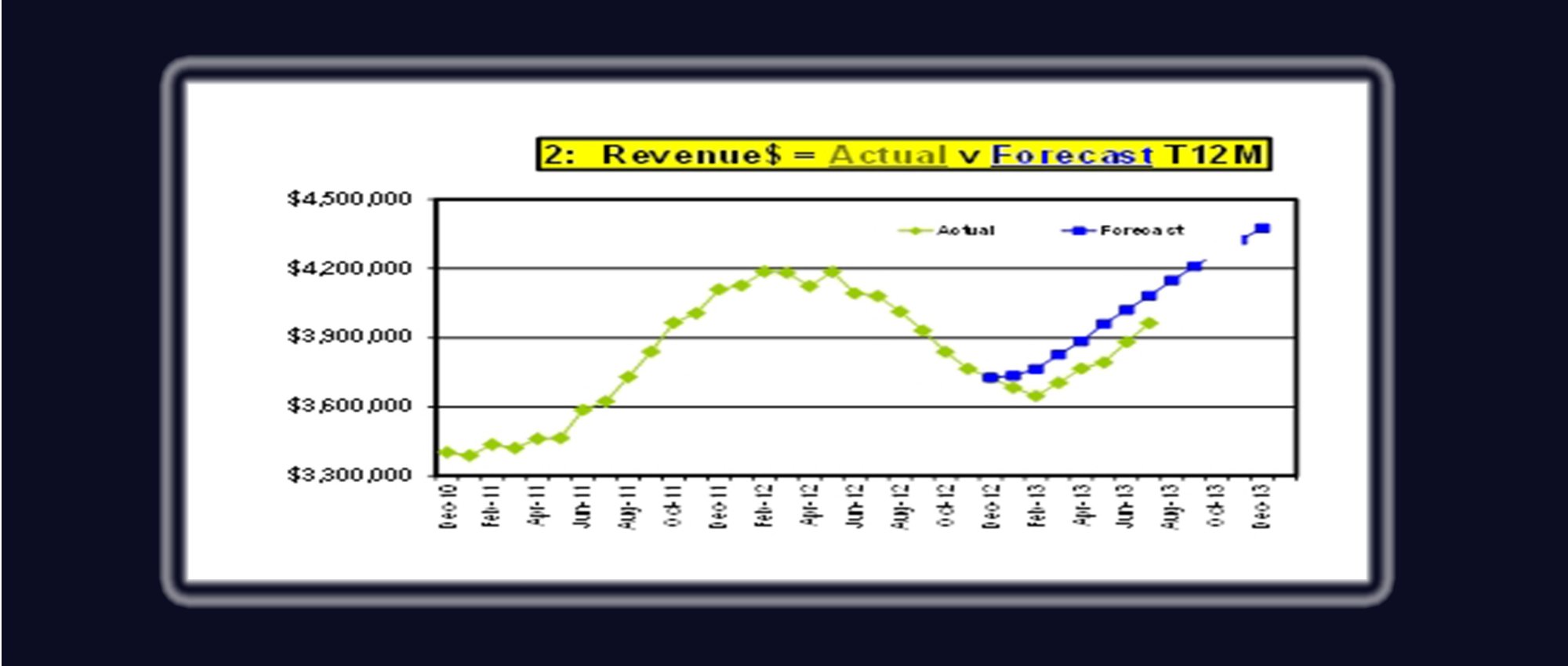

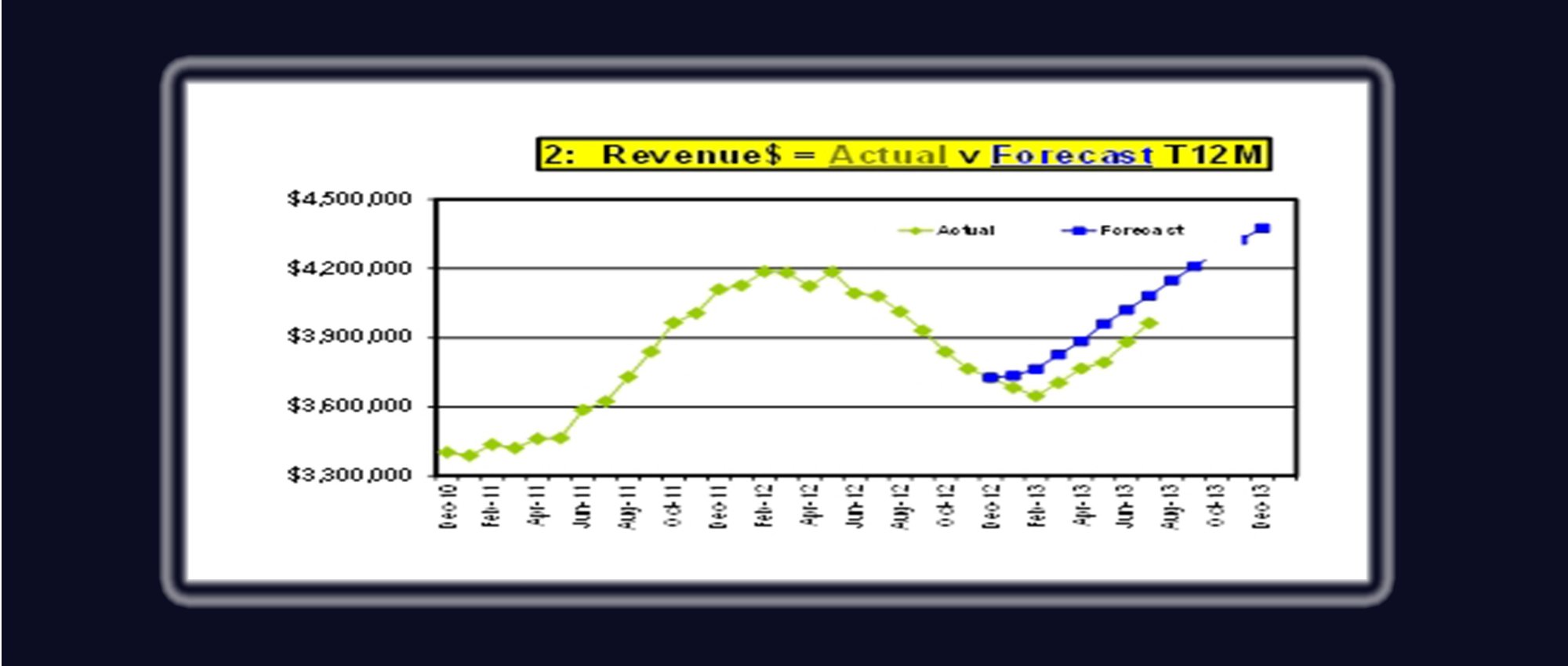

Reoccurring revenue can increase the confidence level of projections and thus raise the value of a business because projections with a large reoccurring revenue base are more stable and increase the probability and surety that the revenue will occur.

Financial Principles

Many companies have died in their growth because they did not track cash flow or the needed cash flow resources. If you graph cash flow and its elements, such as, A/P, A/R, Inventory, capital expense, bank accounts, etc. for the last two years, it becomes much easier to project 12 months into the future and see trends that may have happened in the cash flow area.

Financial Principles

With a 12 month rolling metric any change in slope is significant because a current month replaces a past year month. Any change represents a change in the month’s activity rather than waiting for YTD to get to the 4th quarter.

Financial Principles

Build Value for High Exit – Financially, Operational and Strategically: Let’s say I am a startup, what’s my cost of capital? 20-80%. Growth rate? 15-40%. Mature companies? 10-25%.

That can create a large error. Before and after-tax rates. If you don’t use the right rate, that creates an error. This one, most people don’t know nor have heard about. Does anybody not want to be in business longer than 5 years?

Financial Principles

Cash Flow: If there is a negative cash flow, you feel sad and wonder where it went. If you have positive cash flow then you smile but a monthly view is not very effective. If you graph cash flow and all of its elements, such as, A/P, A/R, Inventory, capital expense, bank accounts, etc. for the last two years, it becomes much easier to project 12 months into the future and see trends that may have happened in the cash flow area.

Financial Principles

Almost all businesses track REVENUE, COST OF GOODS or SERVICES with the resultant – GROSS MARGIN. However, there is a principle called VARIABLE COSTS. A variable cost is one that is a function of revenue. Meaning, when revenue is created; then an expense is triggered. Many hidden variable expenses are accounted for as administration or overhead costs when they are actually tied to revenue and should be categorized as “Variable Expenses”. When all of the variable costs are subtracted from GROSS MARGIN, then a magic number happens called the Contribution Margin (CM).

Financial Principles

Increase Your Company Value Financially. work to obtain renewing contracts, consumable products and create a proactive customer service program (Explained later) to raise the retention and renewal levels which will increase the value of the business significantly.