Corporate Valuation Services

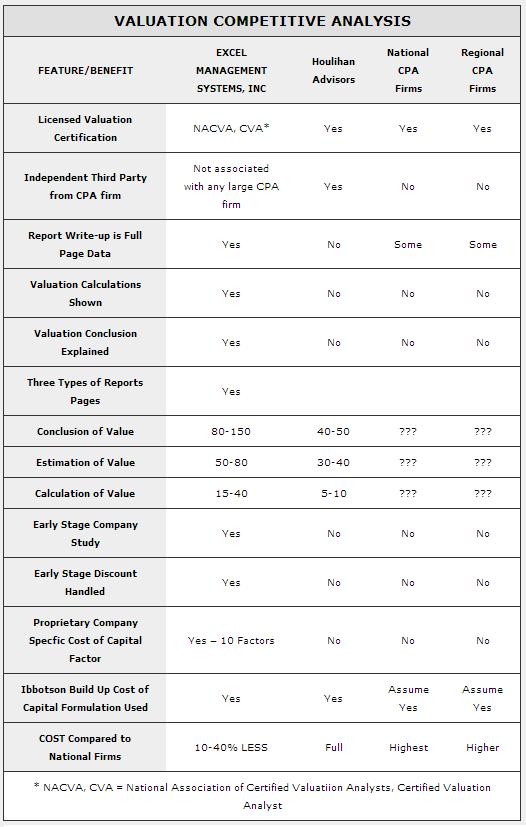

Dale Richards, President of Excel Management Services, Inc. is a licensed Certified Valuation Analyst (CVA) business valuator certified through the National Association of Certified Valuation Analysts (NACVA). He also serves on the Education Quality Assurance Board (EQAB) of NACVA and has been completing valuation analysis work for 29 years.

Dale brings high quality and expertise when performing corporate valuations. Mr. Richards’ costs are typically 20% – 50% lower than regional and national competitors yet the report quality  exceeds the competitors with details of HOW the calculations are made.

exceeds the competitors with details of HOW the calculations are made.

Contact Dale for a quote today.

Why would you need a corporate valuation?

- Employee Stock Option Plans

- IRS rules dictate that you need an annual corporate valuation report

- Merger/Acquisition

- If your company is in negotiations for mergers or acquisitions then a corporate valuation report should take place

- Partial Business Buyout

- Have you been looking to partially buyout a business? Look to us first for corporate valuation services

- Financing or Investing

- You should know your value when investing or financing

- Estate and Gift Tax

- Corporate Valuations are required for Estate and Gift Tax

- Purchase Allocation

- Purchase Allocation requires corporate valuation services

- Fairness Option

- When determining the fairness of mergers, acquisitions, buyback, etc., your company will need corporate valuation services

- Litigation Avoidance

- Let Dale help you avoid litigation with corporate valuation services.

- Life Insurance

- Find the value of your business for life insurance purposes.

- Shareholder Agreements

- When making shareholder agreements you will need a corporate valuation report

- Tax Considerations

- When tax considerations are on the table look to Dale for corporate valuation services

- Buyer/Seller Agreements

- You will need your corporate valuation when you make a buyer/seller agreement

Corporate valuation is needed for many business-related items. Dale Richards is one of the best and most qualified corporate valuation experts.

Feel free to contact us with any questions and we will get you all the information that you need. Corporate Valuation can be a huge task and we know that. Dale will make Corporate Valuation easier on you, your employees, and your business.

A few Valuation Basics:

Maybe you are new to the business world or never needed a corporate valuation until now. Read on to learn the basics of what valuations are.

Valuation is a simple term to define; it is the process of estimating what something is worth. This could refer to you personally, your business, or even a patent.

In finance, valuation analysis is required for many reasons including tax assessment, wills and estates, divorce settlements, business analysis, and basic bookkeeping and accounting. Since the value of all things will fluctuate over time, valuations are as of a specific date. Valuations do not last forever, you will need to get them whenever a big event comes up. Remember value always changes.

There are many reasons why someone would need a valuation done. Maybe you are selling your business. When you sell a valuation will need to take place to determine how much your company is actually worth.

If your company is getting to the stage where you want buyout a company or maybe complete a merger. You will need a valuation for that.

Personally, you will probably purchase life insurance someday or maybe that time is now. You will need a valuation to determine how much you are actually worth.

Best Valuation in the Business

If you are looking for a quality valuation done right, then you are in the right place. Dale has worked in valuations for decades and is willing to help you make your next valuation as painless as possible.

Look around the site to learn more or contact us soon and we can help you out!

Hear what our clients have to say