Optimize Product Pricing/Profits

Knowing when to raise the price is a strategic way to raise profits and can be done without damaging sales or revenue. Do you want to successfully turn your company around? Business Operations Improvement

Knowing when to raise the price is a strategic way to raise profits and can be done without damaging sales or revenue. Do you want to successfully turn your company around? Business Operations Improvement

Vistage Staff did some research to help CEOs and other senior leaders overcome being stuck in the weeds. In their article How CEOs overcome being stuck in the weeds, they address some reliable ways to clear the field and help you to begin to lead the way you envision. Some positives: Plant something for the future: 1. Develop the team, 2. Delegate tasks, 3. Trust your executive team, 4. Overcome fear of failure. Some Negatives: Start digging your way out!

Some CEOs take to retirement much easier than others. Being a CEO has its many perks, and stepping down into retirement means walking away from a lot – if not all of those perks. Retirement is something best eased into carefully. You want to avoid sliding into the home plate, skinning your knees and elbows, and having the umpire call you “OUT”. Allowing yourself time to transition into this new phase of life requires thoughtful planning and preparation. It’s a good idea to plan your exit strategy with your transition team well ahead of time.

Will the changes and expectations you set today change over time? McKinsey’s analysis shows that CEOs are shifting toward each of the four above mentioned areas. As soon as the pandemic period passes, “CEOs will be the ones to decide whether these methods are short-term or will remain a permanent part of their approach to leadership”.

One of the most important small business valuation ideas is to build a company that provides a service not provided by anyone else. If your company can separate itself from others in the marketplace, this is an instant way to increase your value to potential suitors.

If your company can pay down debt, show strong recurring revenue streams and gain a competitive advantage in the marketplace, you are sure to increase the chances that other firms will take notice of your company and potentially look to acquire it through a merger or acquisition.

The use of effective delegation can increase your productivity MANY times over. An exercise I conduct with executives, directors, and managers is a fifteen minutes analysis of their time. For one week, track your activities in 15-minute increments. It may seem tedious but the reward can be great. Most analyses reveal 20%-40% of their time available for delegation. An executive should focus on the key strategic and operational tasks that are prime for their skill set.

The objective of this blog is to point out key activities and methods that will provide the company with quality employees, decreased turnover, increased performance and productivity.

What is a system or process? A series of steps that detail the process for any area. Sales, Marketing, Production, Customer Service, Accounting and any department can have a system.

If you have implemented the “80/20 Customer Gold Program ® ” then there is a specific opportunity to proactively interact with key personnel at your customer’s companies. While you interact, please ask them “Why do you buy from us?” or “Why do you not buy from our competitors?”

So many companies are now using invoicing software to help them when it comes to managing their invoices, but how many companies have invoices at “NET 30 DAYS” or “2% NET 10”? SECRET: Invoice your statements with the date that is 10 days from the date of the invoice. For example: if invoiced on the 1st make the due date the 11th. THEN call between the 7th to the 10th and verify that they received your invoice. These two easy steps will reduce A/R collection from 40-50 days to 20-30 days and save you one-half month of lost monthly cash flow.

A productivity improvement program (“Productivity Pyrami®”) with a pay for performance program where there are company and employee goals with monthly coaching sessions should be implemented. This method can raise company productivity by over 400% and help you get those A performers.

If monthly coaching sessions are held, how easy do you think it would be to hold an employee accountable? Much easier than an annual review.

Many CEOs have asked why a revenue-generating project with a supposed high GM, that should be making money, is actually losing money. The reason is that the CM is not calculated, nor considered in the project proposal and is lower than the GM. then a magic number happens called the Contribution Margin (CM).

A graphical representation of cash flow is one of the most important tools for an executive and should be included on any performance metrics dashboard. Financial Performance Metrics Graphs – Examples. Financial Reporting Dashboard

To be an effective and motivated part of an entrepreneurial management team you have to have the ability to wear many hats at once. Below are some examples.

Management on the commercial level is a whole new ball game. Though some managerial skills are the same across the board, the level of those skills need to show some potential for growth. This may mean that the current management team is perfect for the current setting, but may need to seek outside resources in order to meet the needs of a commercial setting. For instance, how are the finances managed? Small businesses cannot buy in bulk as often and they do not have to make decisions concerning large amounts of money and risk management. If the current management team is unable to realize a profit or get the bills paid under the current circumstances, commercialization may be something they cannot handle.

Cash flow rolling historical and future projections can be a critically important tools for growth, seasonal or shrinking companies. Many companies have died in their growth because they did not track cash flow or the needed cash flow resources.

Have you ever had a good COACH? This often occurs on an athletic team. What are the characteristics of a GOOD COACH? Employee Retention – Recruitment: Lower Expenses. The rule of thumb is if you lose an “A” performer, it takes you 3 years of salary to get them back. Having goals accountability and rewards for your team ensures that you keep your “A” performers because it’s a huge expense to get another one back.

Many companies have died in their growth because they did not track cash flow or the needed cash flow resources. Keys to Performance Metrics | Graphical Dashboard, a 12-month rolling tracking system can work on most performance metrics. It works by adding up the 12 months and graphically representing the sum on a monthly or another time basis. For example, if you add June of the present year; then the previous June is taken out of the sum. With a 12 month rolling metric any change in slope is significant because a current month replaces a past year month. Any change represents a change in the month’s activity rather than waiting for YTD to get to the 4th quarter.

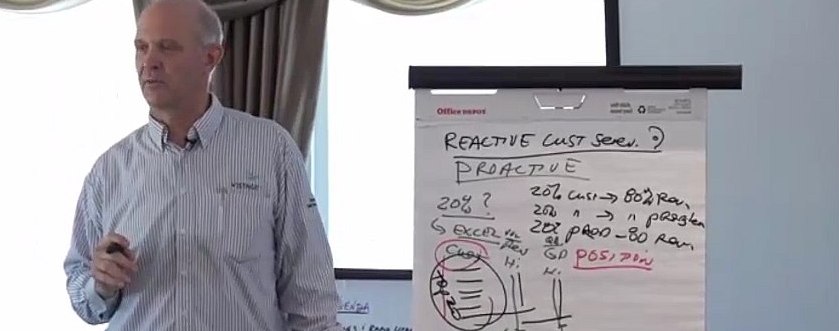

80/20 Customer Gold Program @! What is the Pareto Principle? The 80/20 Rule. This rule was developed back in the 1880s by an Italian/French man and it applies today. What are some examples of the 80/20 principle? First, you must find out who the top 20% of the customers are. Take your customer sales data for the last two or three years and download this data to a spreadsheet. The benefits of this “80/20 Customer Gold Program ®” are significant

With a 12 month rolling metric any change in slope is significant because a current month replaces a past year month. Any change represents a change in the month’s activity rather than waiting for YTD to get to the 4th quarter.

It is recommended that a business valuation is done every two years. With my nine methods and calculations, it can be used as a metric for management performance.With a 12 month rolling metric any change in slope is significant because a current month replaces a past year month. Any change represents a change in the month’s activity rather than waiting for YTD to get to the 4th quarter.

Revenue and how to increase it 2x – 4x! One hundred percent of companies have a revenue goal. Most have a net income goal that is usually only known to upper management. But what other company activities should be company goals? Excel Management Systems, Dale Richards, makes Accounting Principles work to manage a business to 2X-3X revenue, profits and value as testified by Ray Singleton, Denver, Oil and Gas Industry. Ray Learned key business concepts from Dale Richards’ presentation on Business Valuation Principles – How to Increase Your Business Value, Financially, Operational and Strategically.

I’ve identified a number of operational areas where I pinpointed in a 53 element questionnaire and analysis that will guide you to improved performance, success and profits. Business Operations Improvement: I’ve identified a number of operational areas where I pinpointed in a 53 element questionnaire and analysis that will guide you to improved performance, success and profits.

You know you need a detailed plan created with novel proprietary organizational techniques to allow potential funders to see the objectives and details quickly to ensure success. Many CEOs have asked why a revenue-generating project with a supposed high GM, which should be making money, is actually losing money. It is because the CM is not calculated and considered in the project proposal and is much lower than the GM.

There are 2 ways to create systems

a. When you design or quote a project, take a tape recorder, and instead of listening to music as you commute, tell me exactly every step you take to do an estimate. Where do you find it, where the numbers are, the tables you look at. Get a high school kid to transcribe it for $10/hour.

b. Or take someone and have them trained. Say, your job not only is to learn the job, but I want you to write down everything he does step by step exactly what you do.

A 12-month rolling metric tracking system can work on most performance metrics. With a 12 month rolling metric any change in slope is significant because a current month replaces a past year month. Any change represents a change in the month’s activity rather than waiting for YTD to get to the 4th quarter.

Reoccurring or Recurring revenue occurs when a company is able to resell products or services repeatedly to the same customer. If you sell an asset try to sell a consumable product or maintenance contract along with the asset. Reoccurring or Recurring revenue occurs when a company is able to resell products or services repeatedly to the same customer. If you sell an asset try to sell a consumable product or maintenance contract along with the asset.

Year-to-Date (YTD) financial statements are almost useless until the 4th quarter. Year-to-Date (YTD) financial statements are almost useless until the 4th quarter. Almost all financial software programs have YTD as their standard. A much more effective tool is a 12-month rolling history which can also be used to create a 12-month budget monitor.

A 12-month rolling metric tracking system can work on most performance metrics.

You can use account payables (A/P) as a means of financing for your business. You can usually go to 45 days and no one will scream at you. SECRET: Invoice your statements with the date that is 10 days from the date of the invoice.

When businesses are looking to buy your business, they want to take the least risk possible. If your company can pay down debt, show strong recurring revenue streams and gain a competitive advantage in the marketplace, you are sure to increase the chances that other firms will take notice of your company and potentially look to acquire it through a merger or acquisition. Paying off debt is a quick way to increase the value of your business. When you pay down debt, your profit margins instantly increase because you do not have to pay to service your debt.